Lithium: A Critical Mineral for the Energy Transition

Market Opportunity

Lithium mining and lithium exploration are key drivers of the global clean energy transition. Lithium is on the Critical Minerals List in the U.S., Canada, the E.U., and multiple other countries.

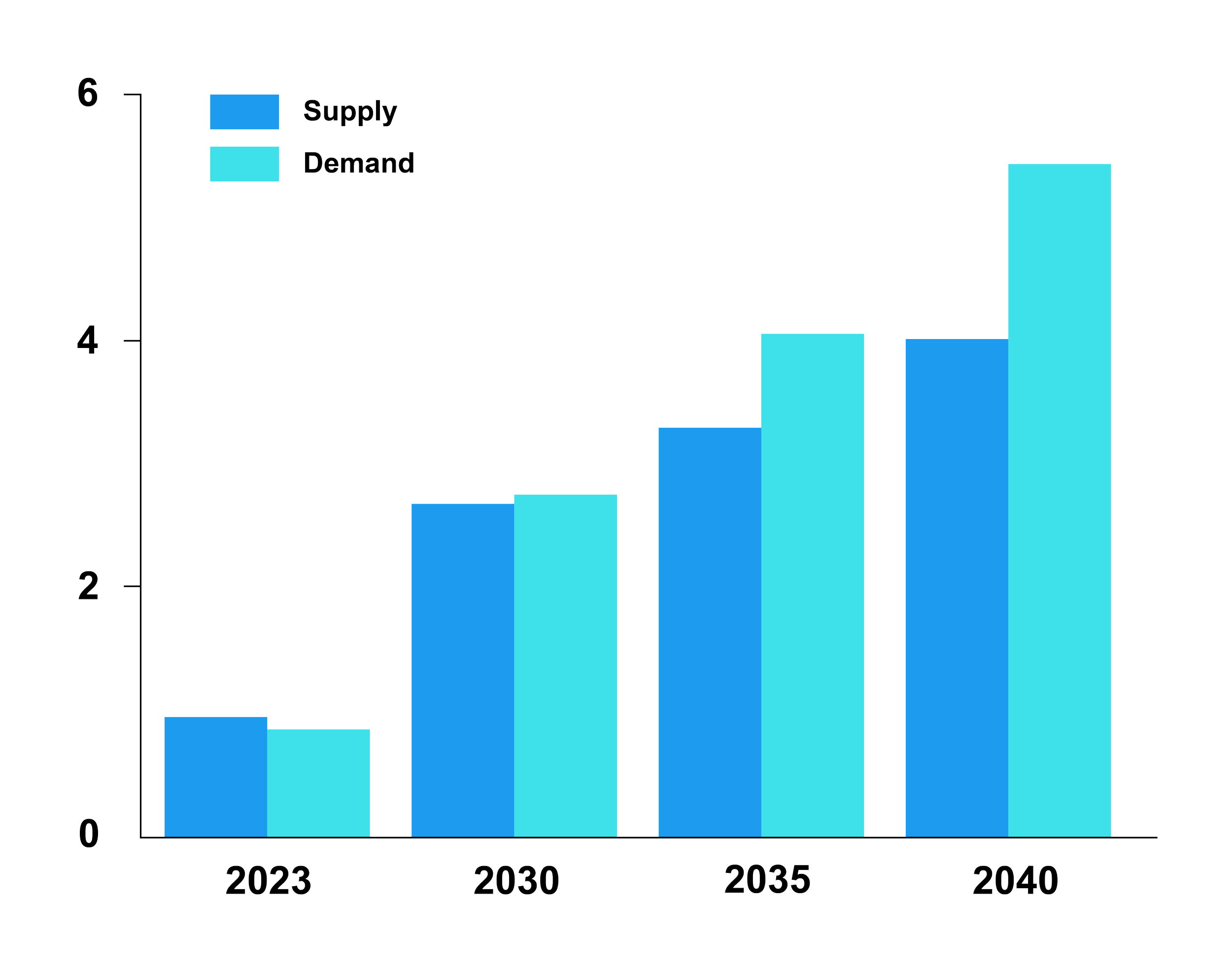

As governments implement decarbonization policies and automakers commit to phasing out internal combustion engines, global lithium demand is expected to outpace supply well into the next decade.

This supply-demand imbalance presents a compelling opportunity for lithium miners, particularly those positioned in politically stable regions with supportive regulatory frameworks.

Lithium supply deficit to emerge by late 2020s:

Lithium’s Primary Uses

Rechargeable batteries for electric vehicles (EVs)

BESS (Battery Energy Storage System) for electricity storage including data centres

Electronics

It also has applications in Pharmaceuticals, Glass, Ceramics and Aerospace.

Lithium is produced from either hard rock pegmatite (spodumene or lepidolite or petalite) or from salar brines (salt lakes).

The two processes for extraction are drastically different, with one being the traditional mining and ore processing with rare metals credits, while the other is more concentrated through solar evaporation ponds, followed by other processes such as membrane technology or solvent extraction. There have also been discoveries of lithium in clay hectorite.

The market price of 99.2% lithium carbonate, the most widely traded price benchmark, was US$ 9,005 per metric tonne on April 2, 2025. This price has been extremely volatile, having been at today's level in 2020, then briefly peaking at US$ 80,000 at the end of 2022, and now back to the current level.

As demand for electric vehicles and battery technologies grows, companies involved in lithium mining are gaining attention, and lithium shares are becoming an increasingly attractive option for forward-looking investors.