Projects

Overview of Canadian Projects

The Company’s projects in Canada, including the Raleigh Lake lithium and rubidium project and the Firesteel copper project, are located within the active northwest Ontario mining region.

Southern Africa

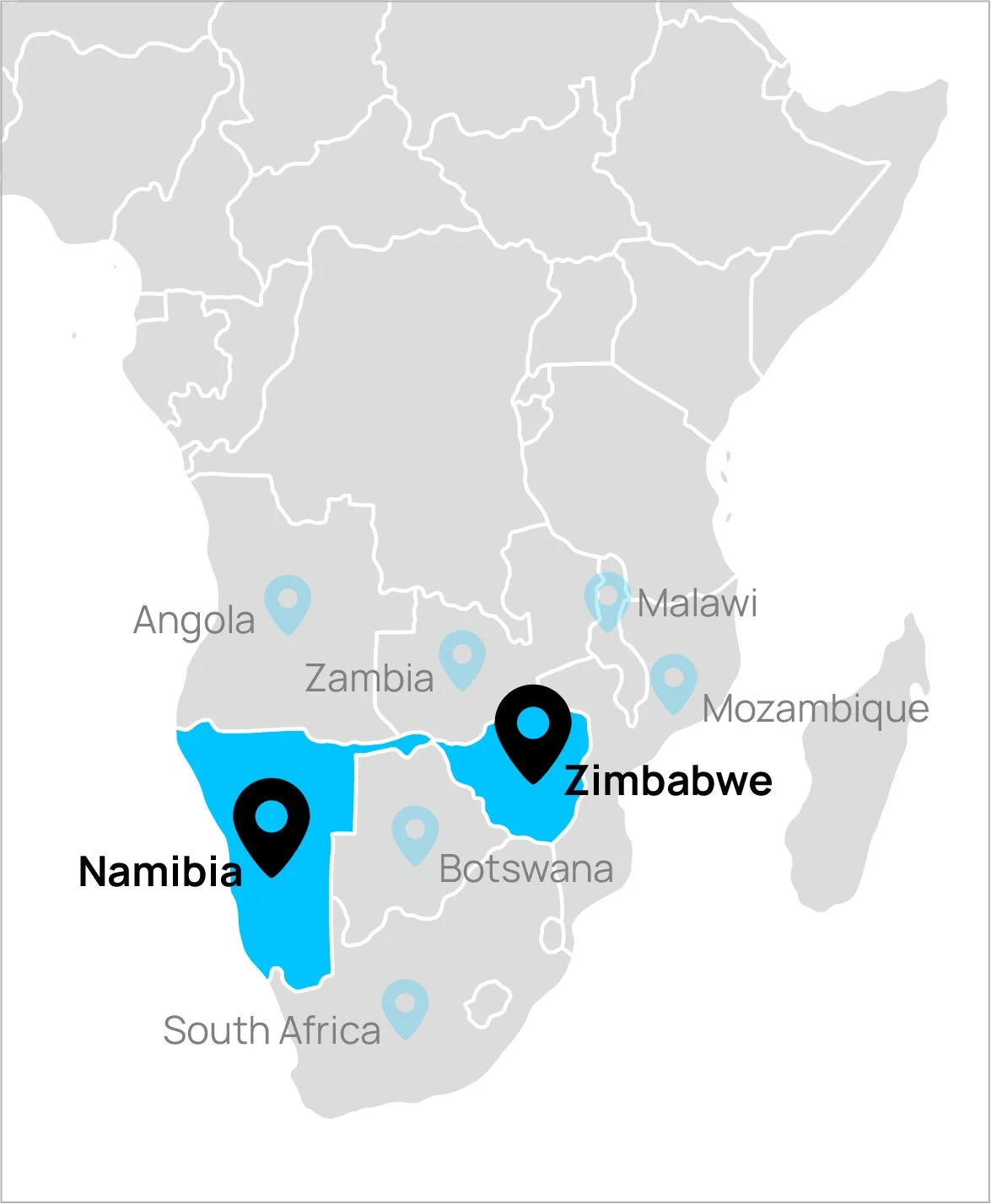

ILC has identified Southern Africa as a key part of its global lithium and critical minerals strategy. With some of the world’s top lithium and critical minerals reserves, Southern Africa offers strong mining potential, skilled workforces, and governments that are increasingly supportive of mining investment.

ILC has acquired an option to buy Lepidico’s 80% interest in the Karibib Lithium, Rubidium, and Cesium Project in Namibia. As well as its significant lithium resource, ILC would on exercising the option acquire the largest disclosed rubidium resource in Africa and also one of the most significant cesium interests of any non-Chinese company. The Project includes a fully permitted mining licence for the areas of the project known as Rubicon and Helikon. Rubicon has had a Definitive Feasibility Study conducted under JORC 2012 standards in 2020, although not at this point under Canadian standard NI 43-101. ILC would also acquire an Exclusive Prospective Licence (EPL) on a neighbouring area with known prospectivity.

ILC has applied for Exclusive Prospecting Orders (EPOs) in several promising areas of Zimbabwe as part of its strategy to expand its global critical metals presence. These regions are known for lithium-rich pegmatites, and initial due diligence has already been conducted. While approvals are pending, the company plans to leverage its expertise to fast-track exploration once access is granted, capitalizing on Zimbabwe’s supportive mining policies and rising role in the global lithium market.

ILC sees strong potential for shareholder returns while contributing to local employment and economic growth. Further updates will be provided in due course.

Other Projects

Although ILC has sold the Mavis Lake and Forgan Lake projects in Ontario, and the Avalonia project in Ireland, it still maintains a financial interest in their success with upside for ILC. In the case of Mavis Lake, this derives from resource estimate milestones; for Avalonia and Forgan Lake, there is a royalty.

| Name | Metal | Location | Area (Hectares) | Current Ownership % | Future Ownership % if options exercised or work carried out |

Operator / JV Partner |

|---|---|---|---|---|---|---|

| Raleigh Lake | Lithium, Rubidium | Ontario | 32 900 | 100% | 100% | ILC |

| Firesteel | Copper, Cobalt | Ontario | 6 600 | 90% | 90% | ILC |

| Wolf Ridge | Lithium | Ontario | 5 700 | 0% | 100% | ILC |

| Mavis Lake | Lithium | Ontario | 2 600 | 0% |

0% (extra earn-in of CAD 0.7 m if resource targets met) |

Critical Resources(ASX:CRR) |

| Avalonia | Lithium | Ireland | 29 200 | 0% | 2% Net Smelter Royalty | Ganfeng Lithium |

| Forgan / Lucky Lakes | Lithium | Ontario | < 500 | 0% | 1.5% Net Smelter Royalty | Power Minerals(ASX:PNN) |